Design the Financial Outcome You Desire

Align The Right Tools To Your Design

Building a strong financial future is a lot like building a house.

Would you start by buying random tools at the hardware store? Or would you start with a blueprint?

At Jimmy Ray Financial, we start with a plan. One that simplifies the process, gives you clarity, and ensures you’re using the right financial tools for your goals.

Designing Your Roadmap

Step 1 — Complimentary Consultations

Step 2 — Collecting & Organizing Data

Step 3 — Identify Risks and Map Out Solutions

Step 4 — Develop Implementation Steps

Step 5 — Collaborate With Strategic Partners

Step 6 — Provide Ongoing Support and Guidance.

Tools To Achieve Success

Tax Planning Strategies

Keep What You Earn

LLC, S Corp, C Corp, LP & LLP

Revocable Living and Irrevocable Life Insurance Trusts

Captive Insurance Companies

Conservation Easements

Charitable Remainder Trusts

Private Foundations

Sale to a Defective Trust

Legacy & Estate Planning

Protect What You’ve Built

Offshore Planning

Self-Canceling Installment Notes

Chronic Illness and Long-term Care

Perpetual Values Trust

Dynasty Trusts

Charitable Lead Trust

Grantor Retained Annuity Trusts

Business Planning

Mitigate Financial Risks

Defined Benefit Plans

Premium Financing

Buy-Sell Agreements

Income Continuation Annuities

Golden Handcuffs

Private Placement Life Insurance

Tax Deferred and “Tax Free” Savings and Investment Vehicles

ESOPS

Cost Of Services

Annual Flat Fee | OR | Annual AUM % Fee

Financial Planning Flat Fee Starts at $2400 per year, or 2% of Gross Annual Household Income (Whichever’s Greatest)

Financial Planning w/ Business Consulting Flat Fee Starts at $4800 per year, or 2% of Gross Annual Household Income (Whichever’s Greatest)

Advanced Business Planning and Legacy Consulting Flat Fee Starts at $9600 per Year, per Client Based on Level of Complexity

Annual AUM Fee of No Greater Than 1% Applicable ONLY to Non-Planning Client Assets Managed, Plus Employer Plans and Captives

Advanced Business & Legacy Planning

With our Advanced Business and Legacy Planning Consulting Services, we’ll focus in on helping you to see the full complete picture and make sure everything is working together as you’ve designed it to. This is a high-touch, strategic approach that considers and integrates multiple financial disciplines.

As part of our process, we’ll likely tackle the following, depending on your core needs:

Exit Strategy Developing

Business Risk Mitigation

Creative Financing

Advance Tax Planning

Charitable Planning

and more!

Best for clients with significant wealth and complex needs.

Employer-Sponsored Retirement Planning

Our record parter offers a cloud-based turnkey record-keeping solution for setting up and managing employee savings programs, such as 401(k) and 403(b). They offer flexible plan design, can integrate with over 100+ payroll providers, and have streamlined processes that enable them to offer full-service administrative capabilities including operations, servicing, and 3(38), 3(21), and/or 3(16) compliance. PLUS, we believe they are cost effective for many growing and established businesses. Once an employer’s plan is established with us through our partner, we will work with participants in ensuring they understand and properly utilize their benefits. We’ll also offer Financial Wellness luncheons and other financial educational resources.

Foundational Financial Planning Services

Foundational Financial Planning is about ensuring that you’re continuing to build and protect your financial future on solid ground. This approach will provide a comprehensive look at your financial picture and give you the blueprint needed to tackle financial concerns and goals one step at a time.

As part of our process, we’ll likely tackle the following, depending on your situation:

Business Planning Services (foundational)

Retirement Planning

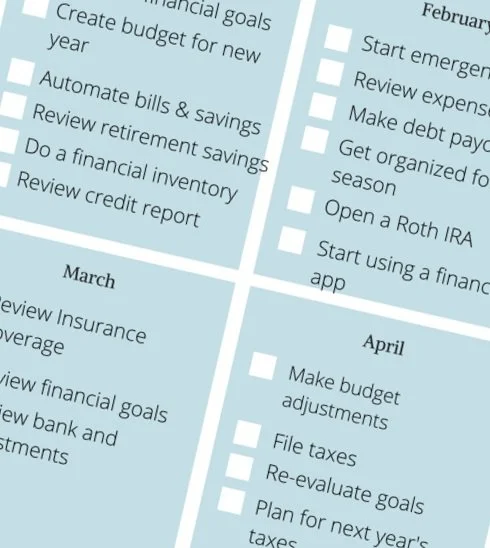

Cash Flow / Budgeting

ROTH Conversions or Other Tax Planning

Insurance and Risk

Best for broad planning needs.

Additional Financial Planning Tools We Use

Insurance Products

Life | Health | Annuities

We can broker non-proprietary, best-in-class insurance products available in the marketplace today.

Savings Solutions

401(k)/403(b) | IRAs | Banking

Looking to open a business investing or retirement account? Or roll over an existing account? Yes, we can help!

Power of Zero | Infinite Banking

We can help you execute any financial strategy that’s right for you and protect you from the ones that aren’t.