Built Something Amazing?

Let Us Protect it.

As Business Financial Planners We’ll Help You Plan Your Exit, Mitigate Risks, Transition With Confidence, and Protect What You’ve Built.

Concrete A Plan of Your Design

“Most people focus on making money. Few have a plan to maximize and protect it—especially when life throws the unexpected their way.

Oftentimes, the financial risks of not having a plan can cost us more money than we make and in less time than it took to make it.

At Jimmy Ray Financial, we’ll create, manage, and help you implement an ongoing plan and strategy that mitigates risks, maximizes profits, and protects what you’ve built.

We’ll turn chaos into clarity and problems into solutions.”

A Straight-Forward Process

Step 1 — Complimentary Consultations

Step 2 — Collecting & Organizing Data

Step 3 — Identify Risks and Map Out Solutions

Step 4 — Develop Implementation Steps

Step 5 — Collaborate With Strategic Partners

Step 6 — Provide Ongoing Support and Guidance.

Strategies For Business Owners & Their Families

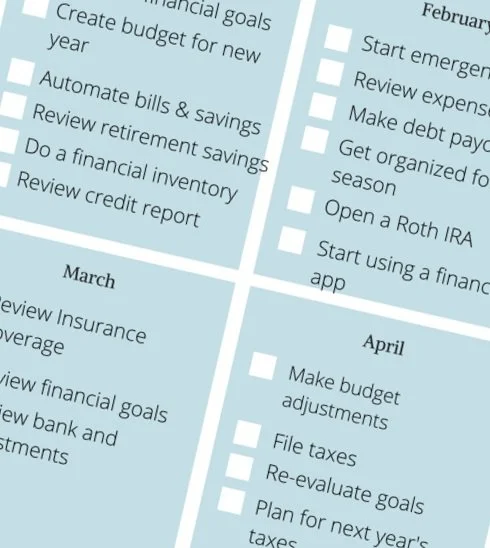

Tax Planning Strategies

Keep More of What You Earn

Every person or business that generates an income is in partnership with the Internal Revenue Service. So, when the proceeds of our earnings pays out, our partner, the IRS wants their cut. Clients entering an exit or transition event are uniquely exposed to tax risk. As a part of our planning strategy, we look for ways to reduce or mitigate tax risk using both conventional and unconventional approaches, so you can keep more of what you earn and protect what you’ve built.

Legacy & Estate Planning

Protect What You’ve Built

For many of us, when given the choice we would desire that our surviving families live on with the values and wealth that we’ve passed on to them. But without a plan of our design, we must default to the whims of the government’s plan, which more ofter than not leaves the surviving family directionless and at times resentful of their inheritance. We make sure that there’s a ongoing, fluid plan of your design to keep you in control over what happens to the legacy you’ve built.

Mitigate Financial Risks

One of the biggest financial risk we all face is not having enough when we need it most. Second to that is having to borrow, liquidate on unfavorable terms, or rely on the good graces of others to fill the financial need. In our planning process we consider when you might need resources and plan for where those resources will come from. Whether that means planning a tax efficient way to turn “brick and steel” into maximum cash for retirement, or protecting your wealth with insurance.

Our Foundational Core Values

TRANSPARENCY

We believe in utter transparency because without it, we can’t serve our clients, and clients cannot trust in our solutions. We believe in mitigating ambiguity and the wonder of uncertainty.

PERSISTENCY

We believe that ALL things are possible and that EVERY financial problem has a solution. We believe in persistence and will leave no rock left unturned when finding solutions.

RESPONSIBILITY

We believe in taking ownership for the decisions we make and for the outcomes of those decisions (or indecisions). We believe in taking responsibility for the mistakes we make and we believe in making it right, if ever and whenever we can.

INTEGRITY

We believe in absolute integrity, which means we believe in being honest and living by strong moral principles. We believe in telling the truth to our clients, even if they don’t like it.

OBJECTIVELY FACTUAL

We believe in knowing and understanding the objective facts before jumping to conclusions. We believe in minimizing decisions based on hearsay and conspiracy in all instances.

PRUDENCY

When it comes to investing, we believe that, “An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. And that, “Operations not meeting these requirements are speculative.”

Taking The Next Step

Ready to begin maximizing your earnings and protecting your legacy?

The next step starts with having a conversation about your goals…

Other Ways to Connect

Looking to Connect About Something Else?

If you’re a wholesaler, agency, issuer, community leader or organization looking to connect with Jimmy Ray, please share your information and Jimmy will reach out when available.